Wallet, Bill Presentment & Payment Solution (Bank Partnership)

A PinPay Solution

This solution was a collaboration between PinPay and a bank in the UAE to host PinPay's biller/merchant acquiring platform on the bank's digital platforms, namely, their mobile banking and online banking channels. Through this solution, companies can present their bills and products/services on the bank's channels. Bank customers can then view, manage and pay their bills from any of these channels.

My Role

Being the Product Manager and lead for this project was challenging; there was a lot of travel and workshops involved, flying several times a month between Lebanon and the UAE to meet with the relevant stakeholders.

Because of the significance of this project, every developer, tester, designer and product owner currently in the company was assigned to the design and build of this product. The project ran for a little over a year, and was unfortunately discontinued before its release due to bureaucratic reasons between upper management from both parties.

Despite the product's failure to realize, I have learned a lot from this experience and have documented and detailed my learnings on this page.

Product

The collaboration between PinPay and the bank was a straightforward one; the bank was seeking an innovative solution to offer their corporate and retail clients and the idea was to localize our existing product and integrate it within the bank's digital channels (Mobile Banking and Internet Banking platforms).

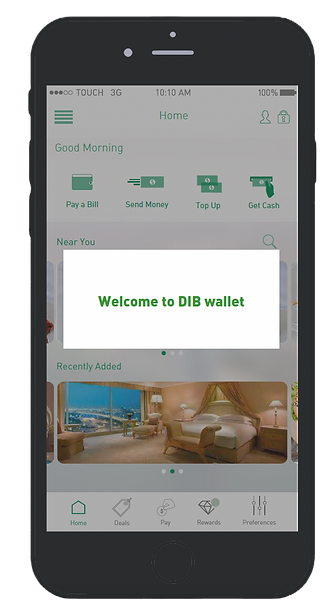

Mobile Wallet Features

The mobile wallet will enable bank customers to register for a wallet account, link their local bank accounts and cards (internal and external accounts/cards) to it, fund their wallets via agents or ATMs, transfer money (locally and internationally), pay bills, perform payments on M-POS, conduct online transactions and access a catalog of offers and deals.

Bank Portal

PinPay was also to design and build a bank portal that would enable the bank to manage their digital wallet customers, their SME's (billers and merchants), monitor all transactions taking place, manage the system's settings and so on. This portal is intended to provide the bank with a 360 overview of the entire wallet system.

Biller/Agent Portal

Billers are companies that provide bill payment services (example: your phone bill). The bank has its own list of billers that they wish to onboard to the platform and expose the biller's services to their wallet clients through the mobile app. Wallet customers can then inquire their bill amount and pay them through the app.

This portal was therefore designed to enable billers to easily create, upload, settle and manage their bills through the platform.

As PinPay had a majority of these features already built into its core system, it was a matter of localizing the platform and customizing certain components to align with the bank's requirements. From the bank's side, there was also a sizable amount of work to be done to modify and prepare its system for the solution.

Story

The amount of work to be done on both sides was challenging and required a committed, joint effort to ensure success of the project. Towards the end of the project's duration, we have documented nearly 1,000+ pages of business and technical requirements, wireframe designs and operational manuals.

Back in 2016, the technological innovations taking place within the banking sector in the UAE was still in its early stages. There were a number of prominent players in the bill and digital payment space, but despite this, the market presented ample opportunity for PinPay to make its mark. The partnership with a local and large bank was the initial stepping stone.

During our early discussions with the bank, one of the key topics of conversation was to understand who exactly were our target market. The bank's current clientele made the most sense, but PinPay's technology coupled with the bank's legal framework, would allow us to extend our reach beyond in-house customers. The bank wanted a solution that would enable them to capture external customers - both residents and visitors (users who were not residents of the country - tourists). Offering the thousands of tourists who visited the country an opportunity to open a local, digital account was an ambitious initiative, but was also something planned for in the product's roadmap. That said, all our designs and workflows (from onboarding and KYC, to payments and reconciliation), made sure to account for the tourist customer type.

Here is a sample of the customer onboarding journey:

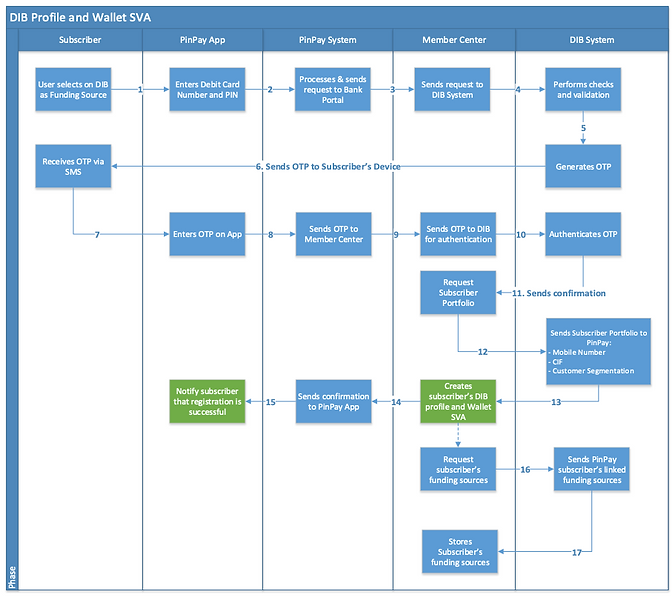

Funding the Wallet SVA

Another key discussion point was the funding of the wallet itself. PinPay as a business was one of the first companies in Lebanon to be licensed by the Central Bank to operate a wallet, hold funds and conduct transactions. However, as we had no legal foundation in the UAE at this stage of the project, we relied on the bank's licenses and standing as a financial institution to be the custodian of funds. PinPay in this context would be the technology provider responsible for creating the wallet and initiating transactions between accounts.

Here is a sample of a wallet funding workflow:

Towards the end of the project, we had managed to design and build all the required portals, mobile apps (iOS and Android) as well as account for all the workflows that were part of the phase 1 release. Although the product failed to launch in the UAE market, much of its backbone and features were later reused for local and regional projects (such as further integrations and partnerships with Lebanese banks).

Key Takeaways

-

Strengthened my communication and management skills working with various stakeholders in the UAE.

-

Learned from my mistakes made on both a business and product level; not to overpromise and under-deliver, resource management, time management, buy-ins and commitments.

-

Expanded my knowledge on the UAE banking sector, the regulations and financial processes.

-

This project brought the entire team closer - working overnights, hard deadlines for product demos and last minute flights. Growing as a team and as a family greatly strengthened our resolve and we carried this with us in all future projects.